Disclosure: This is a sponsored post in partnership with College Ave Student Loans and Her Campus Media. As always, all thoughts and opinions are my own.

I'm keeping it real and talking money today. In 2 months I'll be going back to graduate school for my Master's in Occupational Therapy. Yes, I made the cut!, woop woop. I'm really excited about it all, but lately I've just been a bit stressed filling out tons and tons of paperwork.

Going back to school while I'm still paying off undergraduate student loans is pretty daunting. 81% of students entering college understand the cost of education but still 80% of students don't have a plan to pay off student loan debt after graduation, which I understand. When I was an undergrad my dad cosigned my loans and helped me out with the paperwork. Now the day of the month when both my rent and student loans come out of my paycheck is so sad, haha.

Being on my own financially now has involved lots of time spent learning about loans. I because amassing debt is scary. I wasn't completely sure how financial aid worked for graduate school, and the different types of loans and interest rates can be really confusing.

Luckily my school has been really helpful and federal financial aid was enough. If not I was going to have to look for private loans, which can be really intimidating. One option to simplify loans is College Ave, an online marketplace with competitive rates, repayment options, and a mobile-friendly application that can give you a loan decision in less than three minutes. You can use their tools to see if you pre-qualify and what your rates would be before you even apply for a loan. They have coverage for up to 100% of school-certified expenses with only a minimum loan amount of $2,000.

Even though I didn't need their services, I really liked playing around on their loan calculator to clarify the total cost over the life of a loan and ways to save money by making payments during school or in fewer years afterwards.

I need to be really conscious about my spending and managing my debt. It's amazing how in a blink of an eye you go from graduating college to being close to 30 and realizing you need to start creating actual savings accounts and retirement plans. Yikes.

Here's what I have been doing right now to try to save a few dollars.

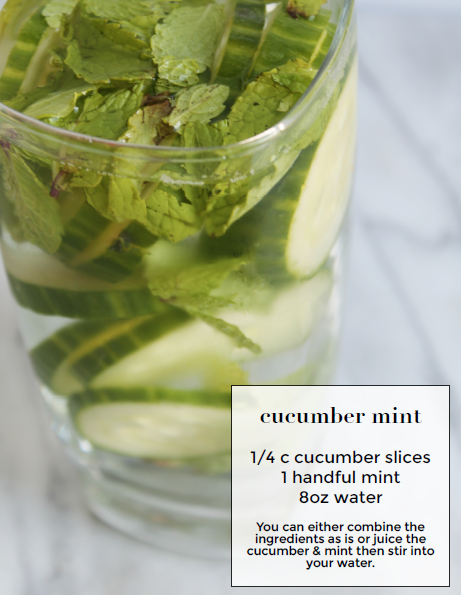

Because honestly I'm not 18 anymore and living off of pizza, mac and cheese, and ramen doesn't cut it!

1. Budget

It's really obvious, yet it's so easy to spend money when you are just swiping a credit card or online shopping. I've used sites like Mint.com in the past, but now just make a rough pen and paper estimate for amounts to spend on specific categories each month. I've got more responsibility now that I'm 27 and not 18, so I make sure my bills & school expenses are taken care of before anything else.2. Use Cash

Recently, I've started taking out cash for the week for minor purchases like coffees or lunches because it's easier for me to stick to my budget. Also something about purchasing with physical cash makes me think twice about my spending.3. Discounts

Besides always asking if there are student discounts with my student ID, I am always am on the lookout for coupons & discounts. Yep, I'm that girl in the grocery store flipping through her coupon folder as she shops. I always check for coupons on RetailMeNot and use Ebates for online shopping .Also my favorite place to buy textbooks online is BigWords. I found it halfway through my college and have used it ever since. You can see prices from online sellers and book rentals all in one place.

4. Buy Only What You Need

This one can be hard sometimes! I definitely need to prioritize my purchases, which means not being able to do each and every thing that sounds fun. With more limited work hours and less income this becomes especially important. That means being conscious with my spending habits like only buying food I'll eat. More sticking to my shopping lists and less Whole Foods yolo purchases.5. Reused & Recycled

Besides always trying to be used textbooks and supplies I need for school, it's amazing what you can buy used. People have so many things that there is always bound to be someone getting rid of just you need on Craiglist, eBay or at Goodwill. I buy & sell clothes on consignment from apps like Poshmark (see my closet here) or places like Plato's Closet.

If you are going back to school or are in school too, check out the #CollegeGoals Instagram scholarship challenge. Now through June 30, share your college goals for a chance to win prizes including a $5,000 scholarship and $50 Chegg textbook credits.

Because who couldn't use a little extra money for school?

What's your favorite tip for saving money? How did you save money in school?

This was linked up with Weekend Snapshots.

This was linked up with Weekend Snapshots.